.png)

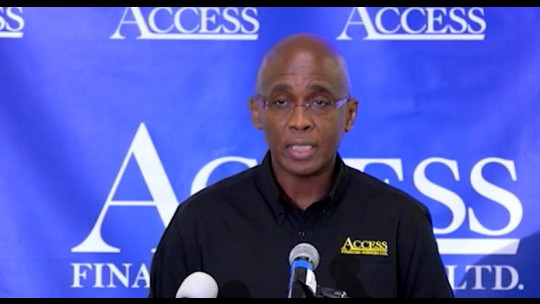

Access Financial CEO Hugh Campbell and Chairman Marcus James

Access Financial Services says it has taken steps to arrest the decline in profitability experienced in the 2022/2023 financial year ended March.

Post tax earnings dropped to $301 million, reflecting a 30 per cent decline.

Addressing the company's Annual General Meeting on Thursday, the company's CEO Hugh Campbell said profits are headed in the right direction so far this year.

"For the three months ended June 30, 2023, Access Financial recorded consolidated net profit after tax of $94 million, compared to $78 million for the same period in 2022. This performance reflects an 8% increase in operating revenues, in line with a growing loan portfolio, an improvement in bad debt recovery. It was however offset by a 4% increase in operating cost."

The group's asset base as at June 30 stood at $6.69 billion, an increase of $853 million or 15% when compared to the prior year.

Meanwhile, Access Financial's Chairman Marcus James said the micro-credit institution is seeing good responses to its investment in technology.

"Corporate bonds that we raised in the September quarter helped us to replace existing debt and provide a financing for IT expenditure and loan disbursement. We are particularly proud of our My Access mobile app, which was successfully launched in the financial year, which has put us at a strategic position to capture more microfinance customers with a faster loan processing time and less hassle for them," he disclosed.

comments powered by Disqus

All feeds

All feeds