.png)

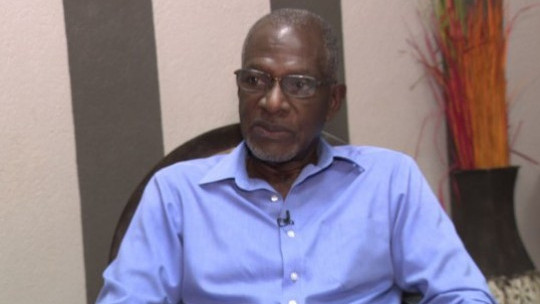

Don Anderson, head of Market Research Services Limited

By Kimone Witter

There has been a dramatic down-turn in consumer confidence in current business conditions for the first quarter of 2024.

Only 10.3 per cent of consumers surveyed thought that business conditions were good, compared with 18.5 per cent in the fourth quarter of 2023.

The findings of the latest Business and Consumer Confidence Survey were presented Tuesday morning by head of Market Research Services Limited, Don Anderson.

"When we look at the first quarter in 2023, 20.4 per cent of the consumers felt that current business conditions were good. And that now has fallen to 10.3 percentage points in the first quarter of 2024. So that's a dramatic falloff in terms of how consumers view current business conditions," Mr. Anderson highlighted.

He said 27.8 per cent of consumers expect business conditions to improve in the next twelve months compared with 27.2 per cent in the previous quarters.

They cited several factors, including signs of improvement in the economy, increased entrepreneurship, and new investments.

On the other hand, Mr. Anderson said the high cost of living was among the concerns of consumers who were not optimistic about business conditions. Other issues they outlined include lack of employment, crime, lack of disposable income and that there is not enough government assistance.

But Mr. Anderson said there was no change in how consumers view the current job situation in the country.

"Jobs have never, as far as the consumer is concerned, been plentiful.... And hence, when we look at this, 10 per cent of the consumers that we interviewed say that jobs are plentiful, only 10 per cent. Now, that of course is something that is a cause for concern, because what drives the economy is how people feel about their job situation," he reasoned.

At the same time, business confidence has remained stable over the last two quarters.

"We can see that we peaked in 2019 based on this five-year band of evaluation. We peaked at 143.6, the index was. We dipped in 2020 to 120, moved up gradually, slowly, to 124.9 in 2021, and began to pick up with...the kind of recession in COVID to 137 in 2022, and we're up to 140, basically, at the end of 2023. So, where are we now? We're pretty much at the same position as we were. We started the year in the same position as we ended 2023," Mr. Anderson disclosed.

comments powered by Disqus

All feeds

All feeds