.png)

By Javaughn Keyes

The Bank of Jamaica says local financial institutions are not moving quickly enough to implement their own central bank digital currency (CBDC) wallets.

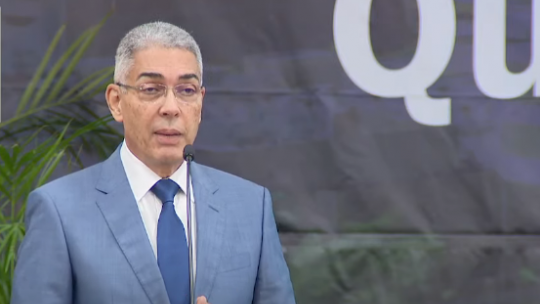

BOJ Governor Richard Byles says the delay may be due to the large amount of capital required for build out.

"Some banks tell me US$300,000, US$500,000, because that's a lot of money to develop a digital wallet. But apart from that, they also have to invest in the equipment to be able to move the digital currency around. So it's the kind of investment that the board of a bank would want to hear you justify, especially since it is not expected that when you and I use Jam-Dex, that they will earn a fee off of it. However, one of the largest expenses that a bank has, especially the large retail banks, is the management of cash," Mr. Byles reasoned.

He said the country does not lack the talent for the development of these applications.

"I believe that we do have a lot of domestic expertise working on these issues. But a large part of the cost involved in creating a wallet is having put it on your phone, how does that interface with the big banking system that currently exists? And a lot of that, those systems are specialised, and they belong to some supplier or the other. And so those suppliers have to get involved to make that interface seamless," he proposed.

Since 2021, NCB's Lynk has been the only digital wallet to accept the local CBDC, Jam-Dex.

comments powered by Disqus

All feeds

All feeds