.png)

00:00

00:00

00:00

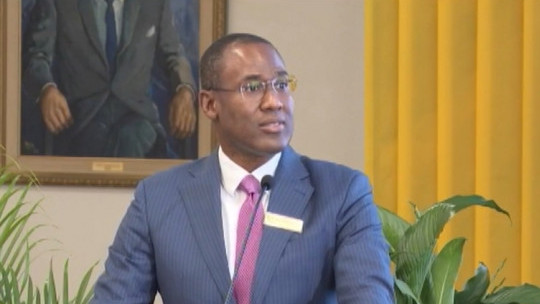

Dr. Nigel Clarke

By Javaughn Keyes

The government has floated the country's first Jamaican dollar linked international bond.

The instrument is valued at $46.6 billion.

In a release Monday, the Finance Ministry said the bond issuance is part of the second phase of a liability management operation.

The proceeds of this bond were used to buy back outstanding US dollar-denominated bonds.

The issuance was oversubscribed 1.4 times.

The bond represents the first Jamaican dollar linked transaction for the Government of Jamaica in international capital markets.

While the issue is denominated in Jamaican dollars, the payouts to bondholders will be in US dollars, determined by the average Jamaican dollar exchange rate over the 10 business days before each payment is due.

Finance Minister Dr. Nigel Clarke says the successful floating of this instrument, provides new opportunities for the country.

"The Government of Jamaica's new ability, demonstrated by this issue, to tap international investors for local currency linked debt serves to broaden and deepen and diversify the government's funding sources while providing the opportunity over time of altering the currency mix of the national debt," he asserted.

This, Dr. Clarke said, makes Jamaica more robust. He added that "the more of our national debt that is denominated in or linked to Jamaica dollars is the stronger and more resilient Jamaica will be".

There is a 7.625 per cent note due 2025, one with a 9.25 per cent return due 2025, and a 6.75 per cent note due 2028.

Some 93.5 per cent of all participants were international investors.

The bond issue marks Jamaica's first return to the international capital markets since 2019.

All feeds

All feeds