Sygnus Credit Investments is looking to raise capital through a Dual Currency Preference Share Offer.

The firm is looking to bring in US$20 million and J$800 million across three classes of Preference Shares.

Jamaican dollar class C shares are selling at $100 each, with a 10.5 per cent return over two years.

Class D US dollar shares are going for US$10 each, over two years at eight per cent.

An 8.5 per cent return is being offered for the class E US dollar shares, also going at US$10 each, over three years.

The offer opens on November 20, and is set to run until December 6.

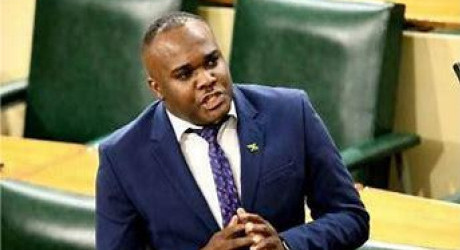

Jason Morris, Chief Investment Officer and Executive Vice President at Sygnus, says the funds will be used to expand its private credit portfolio, scale the business and achieve its strategic goals.

More than US$75 million is earmarked for private credit opportunities across Jamaica.

Sygnus Credit Investment also says it has advanced discussions with international partners for US$100 million, to finance projects across Jamaica and the Caribbean region.

The Preference Shares will be listed on the Jamaica Stock Exchange when the offer closes.

JMMB Securities Limited is the lead broker and co-arranger.

comments powered by Disqus

All feeds

All feeds