.png)

00:00

00:00

00:00

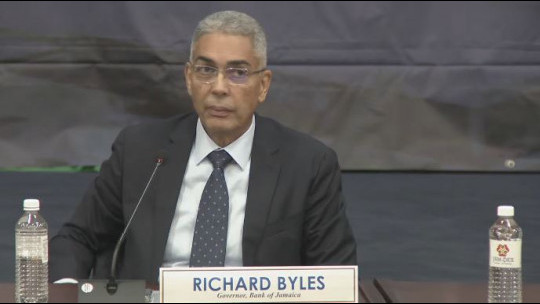

BOJ Governor Richard Byles and Deputy Governor Robert Stennett

The Bank of Jamaica is reporting that it has achieved significant success in its efforts to control inflation.

As reported by the Statistical Institute of Jamaica (STATIN) last week, headline inflation at October was 5.1 per cent, which is within the central bank's target range of 4 to 6 per cent.

October's rate was also below the 5.9 per cent recorded at September 2023, and significantly lower than the peak rate of 11.8 per cent recorded at April 2022.

BOJ Governor Richard Byles said contributors to the lower inflation rate at October were declines in key drivers such as grain prices and lower shipping costs.

"The exchange rate has also remained generally stable, given strong tourism and remittance inflows. However, the annual inflation rate at October continued to be affected by elevated, albeit moderated domestic agricultural price inflation," he noted.

The BOJ Governor said the monetary policy committee, at its meetings on November 17 and 20, projected that inflation would rise above the bank's target range between the period December 2023 to March 2025. This, the committee said, was due in large part to the impact of announced bus and taxi fare increases.

But Governor Byles said this forecast has been revised, given the planned temporary reduction in fares for the Jamaica Urban Transit Company (JUTC).

"In the context of Tuesday's announcement by the Minister of Finance and Public Service of a temporary two-step reduction in JUTC bus fares, effective January 1 and April 1, 2024, inflation is now projected to generally remain within the target range except for December 2023 and a few months in 2024. The announced fiscal measure will have a material impact on tempering the potential inflationary pressures of the PPV fare increases."

In the meantime, Deputy BOJ Governor Robert Stennett said the central bank back to the drawing board in relation to its projections for a fall in consumer prices for the quarter ending December. This is due to the effects of last week's heavy rains on the agriculture sector, with projections of millions of dollars in losses to farmers.

"All of that is now off the table. We are awaiting the data to make a better assessment. But our underlying assumption is that it's going to derail those declines that we are building, the extent to which is something that we will have to assess. Agriculture, as you know, is very important for the CPI. It represents about nine and a half per cent of total consumer prices. So this is something that is going to be the subject of our usual scrutiny," he said.

Mr. Stennett and Mr. Byles were speaking Wednesday at the BOJ's quarterly monetary press conference.

All feeds

All feeds