.png)

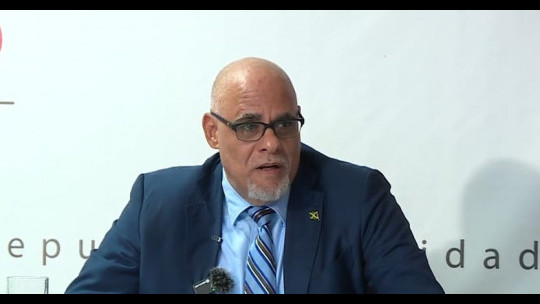

Keith Duncan, Chairman of the Economic Programme Oversight Committee

By Javaughn Keyes

The Economic Programme Oversight Committee is urging the Bank of Jamaica to balance controlling inflation and encouraging economic growth.

Speaking at this quarter's EPOC press briefing, Chairman Keith Duncan said while tighter monetary policy is one step to help stem price increases, it cannot be to the stagnation of economic growth.

"The Bank of Jamaica is quite focused on inflation targeting, but we believe that the BOJ's mandate could possibly take into consideration, balancing inflation targeting with the growth dynamics of the economy, especially given that Jamaica has a little margin for erosion of growth as the economy normalises in its long-term growth range of 1 to 2%."

"Looking ahead, the risk to the domestic GDP forecast are skewed to the downside over the short to medium term, and this depends on the pace of easing of monetary policy, including the pace and quantum of reduction of interest rates, domestic and external demand, also the risk of weather-related shocks," he asserted.

While welcoming the central bank's downward adjustment of the policy interest rate by 0.25 basis points, the private sector has been calling for more to be done to encourage economic growth.

The US Federal reserve's lowering of its benchmark rate is a sign there could be further adjustments in the local policy interest rate which sits at 6.75 per cent.

The next monetary policy decision is due September 30.

comments powered by Disqus

All feeds

All feeds