The Privy Council on Thursday morning handed down judgment in a case involving a former executive of the now defunct Island Life Insurance Company.

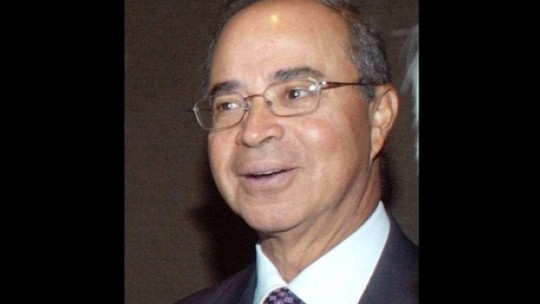

The case involved the distribution of the surplus funds in the company’s pension plan, and saw the London based court siding with former Chief Executive Officer Michael Fraser.

The appellants in the case were the trustees of the Island Life Pension Plan, with Mr. Fraser as the respondent.

Mr. Fraser became President and CEO of Island Life Insurance Company on February 1, 2000 and a month later became a member of the Salaried Staff Pension Plan.

He later sought a transfer of funds accrued during the time he was a member of the Life of Jamaica pension scheme.

A senior officer of Island Life wrote to him, confirming that his money in the Life of Jamaica Plan had been transferred to the Island Life pension plan.

However the trustees only learnt about the transfer on January 1, 2003 when Island Life merged with Life of Jamaica, and the Island Life Plan was being wound up.

They therefore determined that because they had not approved the transfer, Mr. Fraser's share of the surplus should be calculated based only on his contributions while at Island Life.

However Mr. Fraser responded by claiming a share of the surplus based on his total contributions, including the transferred funds.

The trial judge found that it was within the usual authority of the company, as the agents of the trustees to administer the plan, to communicate to Mr. Fraser and that the trustees had accepted the Life of Jamaica transfer.

However she rejected Mr. Fraser's claim on the ground that there was no evidence of detrimental reliance, that is, he had not suffered a loss as a result of being told that the transfer had been approved.

The Court of Appeal affirmed the judge on the question of authority to make the representation, but overruled her on detriment and gave judgment in Mr. Fraser's favour.

The Privy Council has now also decided that the signatory of the transfer had authority to communicate with beneficiaries.

The Law Lords also ruled that there was detrimental reliance, as Mr. Fraser was worse off as a result of being told that his funds had been appropriately transferred.

It therefore ruled that the appeal should be dismissed and that the trustees should pay Mr. Fraser's costs of the appeal to the Board with an indemnity from the funds of the Plan.

All feeds

All feeds