By Javaughn Keyes

The Bank of Jamaica says it is holding consultations with key stakeholders on the Twin Peaks model.

This is the new proposed mechanism for Financial Regulation and Supervision.

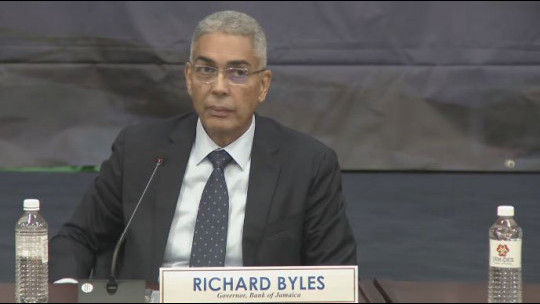

Addressing the inaugural Insurance Association of Jamaica (IAJ) business conference in New Kingston on Wednesday, BOJ Governor Richard Byles said this is part of the implementation of a practice period of the model, prior to the passage of supporting legislation.

The groups being engaged include the IAJ, Jamaica Bankers Association, Jamaica Securities Dealers Association and Pension Industry Association of Jamaica.

Mr. Byles said while the Twin Peaks legislation is not expected to be enacted before 2026, it is important that elements of the new system be instituted prior to its passage.

He explained that “Twin Peaks is really an effort to reorganise who supervises what."

Under the regime, the Bank of Jamaica will be responsible for all institutions in the financial sector, from a prudential point of view, including balance sheets and profit and loss.

The Financial Services Commission will be responsible for market conduct and customer protection.

Mr. Byles said the discussions will also enable stakeholders from the various groups to raise any concerns they may have about the new regulatory model.

The implementation of the Twin Peaks model in Jamaica was first announced in 2023 by Finance Minister Dr. Nigel Clarke.

comments powered by Disqus

All feeds

All feeds