.png)

00:00

00:00

00:00

The Bank of Jamaica (BOJ) says it is progressing well with plans to make it easier for bank customers to transfer their accounts from one institution to another.

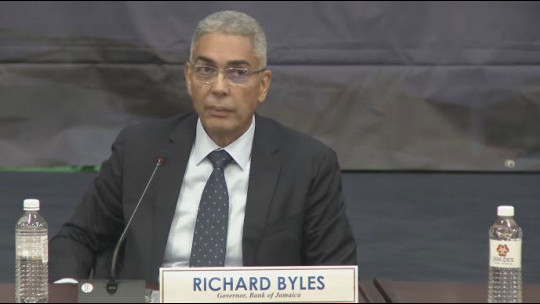

BOJ Governor Richard Byles says the new system will possibly include an electronic Know Your Customer (eKYC) database.

"If every customer's KYC information is stored in one place digitally and a customer wants to move from bank A to bank B, by simply indicating that to the repository that they want to move, their data immediately goes to the other institution and the bank account can be opened within minutes. It's that kind of ease of convenience that consumers want in order to be able to make better choices about who they bank with. So that form of digitisation we are pursuing ourselves," said Mr. Byles.

He disclosed that the central bank is collaborating with the World Bank to develop a central depository of eKYC information.

Mr. Byles also said digital first banking could improve sector efficiency, not only for the current stock of banks but also new, solely digital banks.

"If there are new banks that want to start up and be purely digital we'd be very welcoming of them. I think that to get more competition going we need to get more digitisation going," the BOJ governor reasoned.

_logo.png)

All feeds

All feeds