.png)

00:00

00:00

00:00

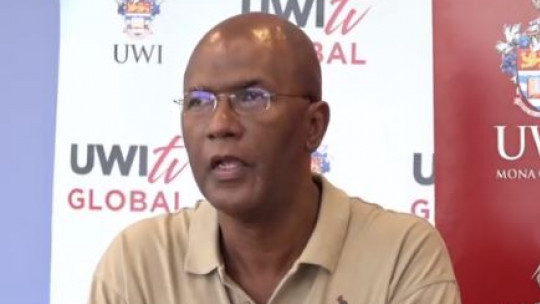

Dr. Peter-John Gordon, economics lecturer at the University of the West Indies, Mona

Pressure is mounting on the government to step in, as commercial banks remain slow to cut lending rates even after a reduction in the central bank's policy rate.

This as the Bank of Jamaica last week lowered the cost of short-term borrowing for commercial banks by 25 basis points from 6 to 5.75 per cent.

Altogether, the central bank cut its policy rate by 125 basis points since 2024, coming from 7 per cent.

Despite appeals from the Ministry of Finance and the BOJ, commercial banks are yet to budge, leaving borrowers still waiting for relief.

Economics lecturer at the University of the West Indies, Mona, Dr. Peter-John Gordon, says the government must now move beyond moral suasion and exert pressure on lending institutions to improve services amid little market competition.

"[BOJ Governor] Richard Byles isn't going to call the banks and give them a tongue-lashing and they do what he says. The problem is the transmission mechanism is not working because the commercial banking sector is not competitive. To have a competitive market, you don't need a whole lot of players. Sometimes two players is enough to have competition," he noted.

Dr. Gordon contended that the non-competitiveness of the banking sector is partly due to the rules put in place by the BOJ.

"And the banks know it, so they are under no pressure to improve services. The role which the banking sector plays is different from any other sector in Jamaica because its inefficiencies pass on to every other sector. The economy cannot grow unless there is an increase in productivity. The banks are an essential part to increasing productivity," he asserted.

Financial commentators say the oligopoly in Jamaica's banking sector is partly to blame for the delay in lowering lending rates. They argue that smaller banks are reluctant to act because major players, Bank of Nova Scotia and National Commercial Bank, control the lion's share of the market assets.

The Jamaica Bankers Association is also being urged to press its member firms to adjust and comply with reduced rates.

The analysts say the dips will be of little to no benefit to the economy if customers are not able to benefit.

But they add that the second reduction by the BOJ was risky, especially since the US Federal Reserve system, which manages the largest economy, said it would assess the impact of Donald Trump's imposed tariffs on China before making any adjustments to its current rate.

All feeds

All feeds