.png)

00:00

00:00

00:00

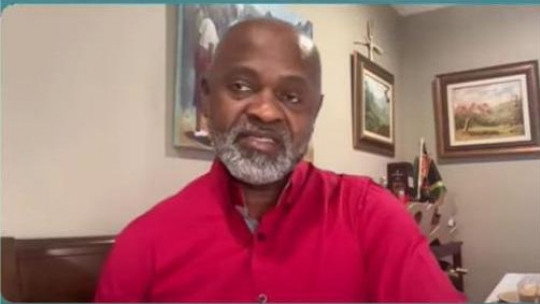

Irwine Claire, Managing Director, Caribbean Immigrant Services

Irwine Claire, Managing Director of Caribbean Immigrant Services in the United States, has expressed concern that the White House will be using the tax on remittance as a tool to identify and deport undocumented migrants living in America.

Effective December 31 this year, Jamaicans in the US sending money to their relatives back home will be required to pay a one per cent excise tax on such transactions.

The tax is set out in the "One Big Beautiful Bill," passed by the US Congress and signed by President Donald Trump on Friday.

There are concerns that this could lead to some migrants sending home less money or sending money less frequently to the island.

Mr Claire, speaking Sunday on Radio Jamaica's That's a Rap, declared that the remittance is part of the US administration's ongoing crackdown on immigrants.

He cautioned that it will be difficult for undocumented Jamaicans in the US to use a middle person to send money home to their relatives.

According to the provisions of the just enacted law, the new tax will be limited mainly to green card holders or permanent residents and visa holders.

Citizens sending money to relatives in Jamaica will not be subject to the new tax.

All feeds

All feeds